Who Accepts Sezzle Virtual Card: A Comprehensive Guide To Expanding Your Payment Options

In today's digital era, the popularity of buy now, pay later (BNPL) services like Sezzle has skyrocketed. Sezzle virtual card is an innovative payment solution that allows users to split their purchases into interest-free installments. However, one of the most common questions from users is, "Who accepts Sezzle virtual card?" This article aims to provide a detailed and comprehensive answer to this question while exploring its benefits, limitations, and usage tips.

As more businesses and consumers embrace flexible payment options, understanding where and how to use your Sezzle virtual card can enhance your shopping experience. This guide will walk you through everything you need to know about Sezzle's acceptance, including merchants, categories, and specific platforms.

Whether you're a new Sezzle user or someone considering this payment method, this article will equip you with the knowledge to maximize your Sezzle virtual card's potential. Let's dive in!

Read also:Comprehensive Guide To Carroll County Obituary 2023 A Detailed Exploration

Table of Contents

- Introduction to Sezzle Virtual Card

- How Sezzle Virtual Card Works

- Merchants Accepting Sezzle Virtual Card

- Categories Supported by Sezzle

- Online Platforms That Accept Sezzle

- Physical Stores Accepting Sezzle

- Benefits of Using Sezzle Virtual Card

- Limitations of Sezzle Virtual Card

- Tips for Using Sezzle Virtual Card

- FAQ About Sezzle Virtual Card

Introduction to Sezzle Virtual Card

Sezzle virtual card is a digital payment solution offered by Sezzle, a popular BNPL service provider. It enables users to make purchases online or in-store using a virtual card number that links directly to their Sezzle account. This feature allows for seamless transactions without requiring merchants to integrate directly with Sezzle's platform.

The virtual card works similarly to a traditional debit or credit card but operates on an interest-free installment plan. Users can split their payments into four equal installments over six weeks, making it an attractive option for those looking to manage their finances more effectively.

How Sezzle Virtual Card Differs from Traditional Cards

Unlike traditional credit cards, Sezzle virtual card does not charge interest or late fees. Instead, it focuses on providing a transparent and user-friendly payment experience. Here are some key differences:

- No interest charges

- No hidden fees

- Instant approval for eligible users

- Works with any merchant that accepts Visa or Mastercard

How Sezzle Virtual Card Works

Using Sezzle virtual card is straightforward. Once you have a Sezzle account, you can generate a virtual card number within the app or website. This number can then be used wherever Visa or Mastercard is accepted. Below are the steps to use your Sezzle virtual card:

- Log in to your Sezzle account

- Generate a virtual card number

- Enter the virtual card details during checkout

- Complete the purchase and pay in four interest-free installments

This process is designed to be quick and convenient, allowing users to take advantage of BNPL benefits without the hassle of direct merchant integration.

Merchants Accepting Sezzle Virtual Card

One of the biggest advantages of Sezzle virtual card is its wide acceptance. Since the virtual card functions as a Visa or Mastercard, it can be used at millions of merchants worldwide. Here are some examples of popular merchants that accept Sezzle virtual card:

Read also:Ginny Di Age A Comprehensive Exploration Of Her Life And Legacy

- Amazon

- Walmart

- Target

- Best Buy

- Nordstrom

- ASOS

While not all merchants explicitly list Sezzle as a payment option, the virtual card expands its usability by leveraging widely accepted payment networks.

International Acceptance

Sezzle virtual card is not limited to domestic use. It can also be used for international purchases wherever Visa or Mastercard is accepted. This makes it an ideal choice for global shoppers who want to enjoy the benefits of BNPL across borders.

Categories Supported by Sezzle

Sezzle virtual card supports a wide range of product categories, making it suitable for various shopping needs. Some of the most common categories include:

- Apparel and accessories

- Electronics and gadgets

- Home and kitchen appliances

- Health and beauty products

- Groceries and food delivery

- Travel and hospitality services

While Sezzle does not impose strict limitations on what you can purchase, users should ensure they adhere to their account's spending limits and eligibility criteria.

Online Platforms That Accept Sezzle

Many online platforms accept Sezzle virtual card due to its compatibility with Visa and Mastercard networks. Below are some popular platforms where you can use your virtual card:

- Shopify stores

- eBay

- Etsy

- AliExpress

- Rakuten

These platforms cater to a diverse range of products, giving Sezzle users ample opportunities to utilize their virtual card for online shopping.

Subscription Services

In addition to one-time purchases, Sezzle virtual card can also be used for subscription services. This includes streaming platforms, software subscriptions, and monthly boxes. However, users should verify the platform's payment policy to ensure compatibility.

Physical Stores Accepting Sezzle

While Sezzle virtual card is primarily designed for online transactions, it can also be used at physical stores that accept Visa or Mastercard. Some popular retailers that accept Sezzle in-store include:

- Apple Stores

- Gap

- Urban Outfitters

- H&M

- Target

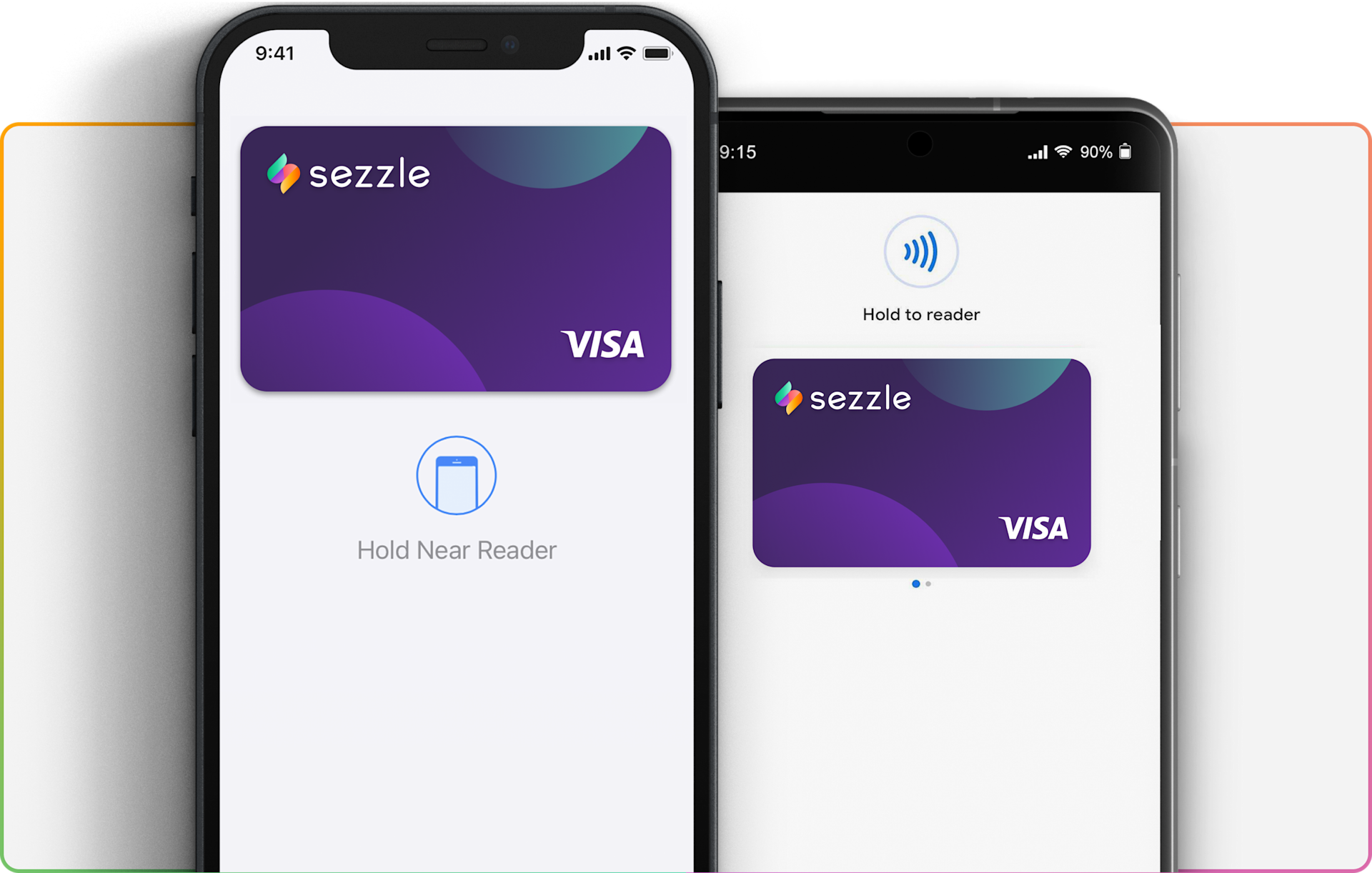

To use your virtual card in-store, simply generate the card number in the Sezzle app and enter it manually at checkout or link it to a digital wallet like Apple Pay or Google Pay.

Benefits of Using Sezzle Virtual Card

Sezzle virtual card offers several advantages over traditional payment methods. Here are some of its key benefits:

- Interest-free payments: Split your purchases into manageable installments without incurring interest charges.

- Wide acceptance: Use your virtual card wherever Visa or Mastercard is accepted.

- Improved cash flow: Pay in installments to better manage your finances.

- Enhanced security: Virtual card numbers provide an extra layer of protection against fraud.

These benefits make Sezzle virtual card an attractive option for both casual shoppers and budget-conscious consumers.

Limitations of Sezzle Virtual Card

While Sezzle virtual card offers many advantages, it does have some limitations. Understanding these can help users make informed decisions about its usage:

- Spending limits: Users may face restrictions based on their account eligibility and credit history.

- No cash withdrawals: Sezzle virtual card cannot be used for ATM transactions or cash advances.

- Merchant restrictions: Some merchants may not accept virtual card numbers due to security policies.

Despite these limitations, Sezzle remains a viable option for those seeking flexible payment solutions.

Tips for Using Sezzle Virtual Card

To maximize the benefits of your Sezzle virtual card, consider the following tips:

- Always check merchant policies before using your virtual card.

- Monitor your spending to stay within your budget and Sezzle limits.

- Use digital wallets for added convenience and security when shopping in-store.

- Review your account regularly to ensure timely installment payments.

By following these tips, you can optimize your Sezzle virtual card experience and avoid potential pitfalls.

FAQ About Sezzle Virtual Card

Q: Is Sezzle virtual card secure?

Yes, Sezzle virtual card uses advanced encryption and tokenization technology to protect your financial information. Additionally, virtual card numbers provide an extra layer of security by replacing your actual card details during transactions.

Q: Can I use Sezzle virtual card for recurring payments?

While Sezzle virtual card can be used for subscription services, its compatibility with recurring payments depends on the platform's policies. Always verify the platform's requirements before setting up automatic payments.

Q: Are there any fees associated with Sezzle virtual card?

No, Sezzle virtual card does not charge interest or hidden fees. However, users may face late fees if they miss an installment payment.

Conclusion

In summary, Sezzle virtual card is a versatile and convenient payment solution that expands the usability of BNPL services. By leveraging Visa and Mastercard networks, it offers wide acceptance across millions of merchants worldwide. Whether you're shopping online or in-store, Sezzle virtual card provides a flexible and secure way to manage your finances.

We encourage you to explore the possibilities of Sezzle virtual card and take advantage of its many benefits. Feel free to leave a comment below or share this article with others who may find it helpful. For more insights into financial tools and payment solutions, explore our other articles on the website.

References: