Comprehensive Guide To Greenville County SC Assessor's Office

Understanding the Greenville County SC Assessor's Office is essential for property owners and those interested in real estate within the region. This office plays a vital role in property tax assessment and valuation, which directly impacts homeowners and investors alike. Whether you're looking to buy, sell, or manage property, this guide will provide you with all the necessary information you need to know about the Greenville County SC Assessor's Office.

Property taxes are a significant financial responsibility for homeowners, and accurate assessments are crucial for maintaining fair and equitable taxation. The Greenville County SC Assessor's Office ensures that every property within the county is evaluated fairly and transparently. This process not only affects individual property owners but also contributes to the overall economic health of the county.

In this article, we will explore the functions, responsibilities, and services provided by the Greenville County SC Assessor's Office. Additionally, we'll delve into how property assessments are conducted, the importance of staying updated with property values, and resources available to assist property owners. By the end of this guide, you'll have a comprehensive understanding of how this office operates and its significance in Greenville County.

Read also:How To Wear Beanies A Comprehensive Guide For Every Style And Occasion

Table of Contents

- Overview of Greenville County SC Assessor's Office

- Key Functions and Responsibilities

- Property Assessment Process

- Tools and Resources for Property Owners

- Impact of Property Assessments on Taxes

- Appealing Property Assessments

- Statistical Data and Trends

- Legal Framework and Compliance

- Contact Information and Support

- Conclusion and Next Steps

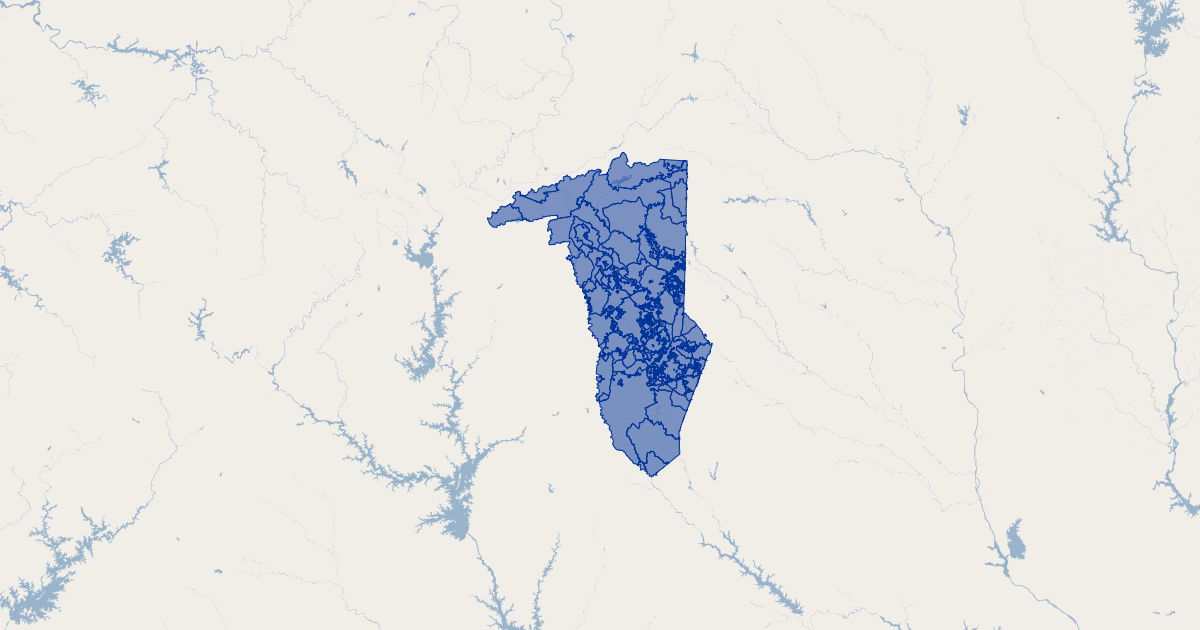

Overview of Greenville County SC Assessor's Office

The Greenville County SC Assessor's Office is a critical component of the county's administrative framework, responsible for evaluating and assessing property values. Established to ensure fair and accurate property tax assessments, this office serves as a resource for property owners, real estate professionals, and government entities. Its primary goal is to maintain an equitable system of taxation that supports the county's infrastructure, public services, and overall economic growth.

This office operates under strict guidelines set by state laws and regulations, ensuring transparency and accountability in all its operations. By leveraging advanced technology and data analytics, the Greenville County SC Assessor's Office provides up-to-date information on property values, ownership, and tax obligations. This commitment to accuracy and efficiency makes it a trusted resource for all stakeholders involved in the real estate market.

Role in Community Development

One of the key roles of the Greenville County SC Assessor's Office is its contribution to community development. Through accurate property assessments, the office helps allocate resources effectively, ensuring that public services such as schools, healthcare, and infrastructure receive adequate funding. This not only benefits property owners but also enhances the quality of life for all residents in the county.

Key Functions and Responsibilities

The Greenville County SC Assessor's Office performs several critical functions that are essential for maintaining a fair and transparent property tax system. These functions include property valuation, record-keeping, and ensuring compliance with state and local regulations. By fulfilling these responsibilities, the office ensures that all property owners are assessed fairly and equitably.

Property Valuation

One of the primary functions of the Greenville County SC Assessor's Office is property valuation. This process involves determining the market value of all properties within the county. Assessors use various methods, including market analysis, cost approach, and income approach, to arrive at an accurate valuation. This ensures that property taxes are based on the current market value, reflecting changes in the real estate market.

Record-Keeping

Maintaining accurate and up-to-date records is another crucial responsibility of the Greenville County SC Assessor's Office. These records include property ownership details, legal descriptions, and assessment history. By keeping comprehensive records, the office provides property owners with a reliable source of information regarding their property's value and tax obligations.

Read also:Rock Hill Sc Arrest A Comprehensive Guide To Understanding The Legal Process

Property Assessment Process

The property assessment process conducted by the Greenville County SC Assessor's Office involves several steps to ensure accuracy and fairness. Initially, assessors inspect properties to gather information about their physical characteristics, such as size, age, and condition. This data is then analyzed using market trends and historical data to determine the property's market value.

Steps in the Assessment Process

- Property Inspection: Assessors visit properties to collect detailed information.

- Data Analysis: Market trends and historical data are analyzed to determine property value.

- Notification: Property owners are notified of their property's assessed value.

- Appeals: Owners have the opportunity to appeal if they believe the assessment is inaccurate.

Tools and Resources for Property Owners

The Greenville County SC Assessor's Office offers several tools and resources to assist property owners in understanding their assessments and managing their property tax obligations. These resources include online portals, mobile applications, and educational materials designed to provide clear and concise information.

Online Property Assessment Portal

The online property assessment portal allows property owners to access detailed information about their property's value, tax obligations, and assessment history. This portal also provides tools for comparing property values within the same neighborhood, helping owners make informed decisions about their real estate investments.

Impact of Property Assessments on Taxes

Property assessments directly impact the amount of taxes property owners must pay. The Greenville County SC Assessor's Office uses the assessed value of a property to calculate the tax bill, which is then sent to property owners annually. Understanding how assessments affect taxes is crucial for budgeting and financial planning.

Tax Calculation Process

The tax calculation process involves multiplying the assessed value of a property by the tax rate set by local authorities. This rate is determined based on the county's budgetary needs and is adjusted annually to reflect changes in property values and public service requirements. Property owners can use the online portal to estimate their tax obligations based on current assessment values.

Appealing Property Assessments

Property owners who believe their assessment is inaccurate have the right to appeal. The Greenville County SC Assessor's Office provides a structured process for filing appeals, ensuring that all concerns are addressed fairly and transparently. This process includes submitting evidence to support the appeal and attending a hearing if necessary.

Steps to File an Appeal

- Gather Evidence: Collect data supporting the appeal, such as recent sales of similar properties.

- Submit Appeal: File the appeal through the designated portal or in person.

- Attend Hearing: Present evidence and arguments during the hearing.

- Receive Decision: The office will notify the owner of the appeal decision.

Statistical Data and Trends

Statistical data and trends provide valuable insights into the real estate market and property values within Greenville County. The Greenville County SC Assessor's Office regularly publishes reports and analyses that highlight changes in property values, sales trends, and tax revenues. These data points are essential for understanding the dynamics of the local real estate market.

Recent Trends in Property Values

Over the past few years, property values in Greenville County have experienced steady growth, driven by increased demand and limited supply. This trend is expected to continue, with projections indicating further increases in property values. Property owners and investors should stay informed about these trends to make strategic decisions regarding their real estate assets.

Legal Framework and Compliance

The Greenville County SC Assessor's Office operates within a legal framework established by state and local laws. Compliance with these regulations ensures that all assessments are conducted fairly and transparently. Property owners are encouraged to familiarize themselves with these laws to understand their rights and obligations regarding property assessments and taxes.

Key Legal Provisions

- State Laws: Governing property assessment and taxation.

- Local Ordinances: Specific regulations set by Greenville County.

- Appeal Procedures: Legal processes for challenging assessments.

Contact Information and Support

The Greenville County SC Assessor's Office provides multiple channels for property owners to contact them and seek support. These include phone lines, email addresses, and in-person visits to their office. The staff is dedicated to assisting property owners with any questions or concerns related to property assessments and taxes.

Ways to Contact the Office

- Phone: Direct line for inquiries.

- Email: Dedicated email address for support.

- In-Person: Office location and hours of operation.

Conclusion and Next Steps

In conclusion, the Greenville County SC Assessor's Office plays a pivotal role in maintaining a fair and transparent property tax system. By understanding its functions, responsibilities, and available resources, property owners can better manage their tax obligations and make informed decisions about their real estate investments. Staying updated with property values, tax rates, and legal requirements is essential for maximizing the benefits of property ownership.

We encourage readers to explore the tools and resources provided by the Greenville County SC Assessor's Office and take advantage of the opportunities to appeal assessments if necessary. For further information, please visit their official website or contact them directly. Additionally, we invite you to share this article with others who may find it beneficial and explore other informative content on our site.