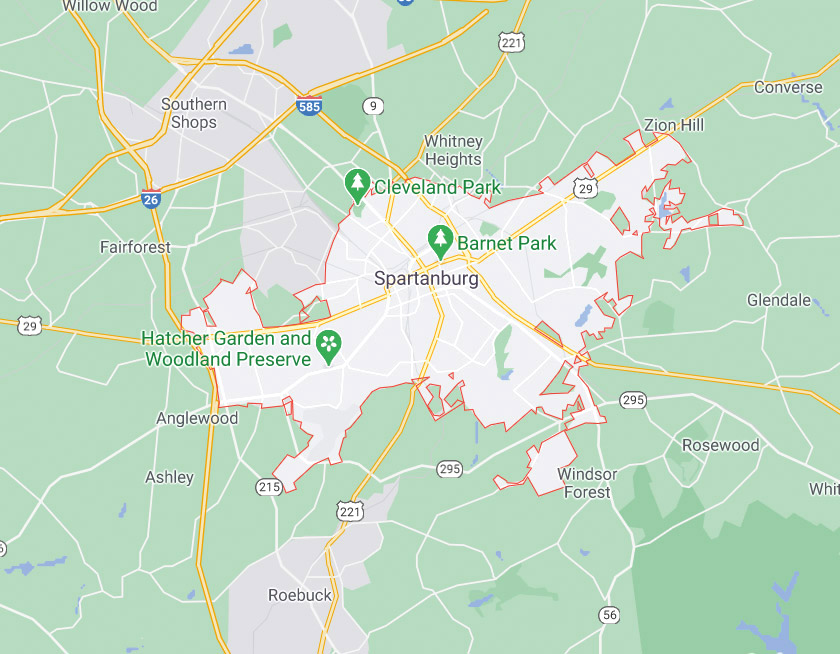

Understanding Property Taxes In Spartanburg County, SC: A Comprehensive Guide

Property taxes are an essential aspect of living in Spartanburg County, SC, as they contribute significantly to the local government's revenue and fund essential public services. Whether you're a homeowner, investor, or someone considering purchasing property in the area, understanding the nuances of property taxes is crucial for making informed financial decisions. This article aims to provide a detailed overview of property taxes in Spartanburg County, helping you navigate the complexities and stay compliant with local regulations.

In Spartanburg County, property taxes play a vital role in maintaining and improving infrastructure, supporting public schools, and ensuring the overall well-being of the community. By understanding how these taxes are assessed, calculated, and applied, you can better manage your finances and avoid potential penalties or complications.

This guide delves into the specifics of property taxes in Spartanburg County, SC, including how assessments are conducted, the rates applied, exemptions available, and the payment process. Whether you're a seasoned property owner or a newcomer to the area, this information will prove invaluable in helping you manage your tax obligations effectively.

Read also:Comprehensive Guide To Modesto Bee Obituaries Modesto California

Table of Contents

- Introduction to Property Taxes in Spartanburg County

- How Property Taxes Are Assessed

- Understanding Tax Rates in Spartanburg County

- Calculating Property Taxes

- Payment Options and Deadlines

- Available Tax Exemptions

- Appealing Property Tax Assessments

- The Impact of Property Taxes on Homeowners

- How Property Taxes Fund Public Services

- Future Trends in Property Taxes

Introduction to Property Taxes in Spartanburg County

Property taxes are a fundamental component of local government revenue in Spartanburg County, SC. These taxes are levied on real estate properties, including residential, commercial, and agricultural lands, based on their assessed value. The revenue generated from property taxes is used to fund essential public services such as education, infrastructure maintenance, law enforcement, and emergency services.

Why Property Taxes Matter

For homeowners and property investors, understanding property taxes is crucial for budgeting and financial planning. Property taxes in Spartanburg County are calculated annually and are subject to change based on factors such as property value assessments, local government budgets, and legislative updates. Staying informed about these changes can help you avoid unexpected financial burdens.

Key Players in the Property Tax System

The Spartanburg County Assessor's Office is responsible for assessing property values, while the County Treasurer's Office manages the collection of property taxes. Additionally, the County Council plays a role in setting tax rates and approving budgets that determine how tax revenue is allocated. Collaboration between these entities ensures a fair and transparent property tax system.

How Property Taxes Are Assessed

Property tax assessments in Spartanburg County, SC, are conducted by the County Assessor's Office. These assessments determine the taxable value of your property, which directly impacts the amount of taxes you owe. The process involves several steps to ensure accuracy and fairness.

Read also:Core Duval County Clerk Your Comprehensive Guide

Assessment Methods

- Market Value Assessment: Properties are assessed based on their current market value, which reflects the price a willing buyer would pay for the property in a competitive market.

- Cost Approach: This method calculates the replacement cost of the property, factoring in depreciation and land value.

- Income Approach: Used primarily for commercial properties, this method estimates property value based on its potential income-generating capacity.

Assessment Frequency

In Spartanburg County, property assessments are typically conducted every five years, with annual updates for new construction or significant renovations. These assessments ensure that property values remain current and reflective of market conditions.

Understanding Tax Rates in Spartanburg County

Tax rates in Spartanburg County, SC, are set annually by the County Council and vary depending on the type of property and its use. These rates are expressed as mills, with one mill equaling one-tenth of a cent per dollar of assessed value.

Residential Property Tax Rates

As of the latest update, the residential property tax rate in Spartanburg County is approximately 57 mills. This rate applies to owner-occupied homes and is subject to change based on annual budget considerations.

Commercial Property Tax Rates

Commercial properties in Spartanburg County are taxed at a higher rate, typically around 65 mills. This reflects the increased value and revenue potential of commercial properties compared to residential ones.

Calculating Property Taxes

Calculating property taxes involves multiplying the assessed value of your property by the applicable tax rate. The formula is straightforward but requires an understanding of the various factors that influence the final tax amount.

Step-by-Step Calculation

- Determine the assessed value of your property, which is typically a percentage of its market value.

- Multiply the assessed value by the applicable tax rate (expressed as mills).

- Divide the result by 1,000 to calculate the total tax owed.

For example, if your property has an assessed value of $100,000 and the tax rate is 57 mills, your property tax would be calculated as follows:

(100,000 x 0.057) / 1,000 = $570

Payment Options and Deadlines

Property tax payments in Spartanburg County, SC, can be made through various methods, offering convenience and flexibility for taxpayers. Understanding the payment options and deadlines is essential to avoid penalties and maintain compliance.

Payment Methods

- Online Payments: Taxpayers can pay their property taxes securely online through the County Treasurer's website.

- Mail-In Payments: Payments can also be made by mailing a check or money order to the County Treasurer's Office.

- In-Person Payments: Taxpayers can visit the Treasurer's Office to make payments in person using cash, check, or credit/debit cards.

Payment Deadlines

Property taxes in Spartanburg County are due annually, with a grace period allowing payments to be made without penalty until the end of the calendar year. Late payments may incur interest and penalties, so it's crucial to meet the deadlines.

Available Tax Exemptions

Spartanburg County offers several tax exemptions to eligible homeowners and property owners, providing relief and reducing the tax burden. These exemptions are designed to support specific groups and promote fairness in the tax system.

Homestead Exemption

The Homestead Exemption is available to South Carolina residents who own and occupy their primary residence. This exemption reduces the taxable value of the property, resulting in lower property taxes. Eligible homeowners must apply for the exemption through the County Assessor's Office.

Senior Citizen Exemptions

Senior citizens aged 65 and older may qualify for additional property tax exemptions, depending on their income and property ownership status. These exemptions aim to provide financial relief to retired individuals on fixed incomes.

Appealing Property Tax Assessments

If you believe your property tax assessment is inaccurate or unfair, you have the right to appeal the decision. The appeals process in Spartanburg County involves several steps and requires documentation to support your case.

Steps to Appeal

- Review your property assessment notice and gather evidence supporting your appeal, such as recent property sales in your area or discrepancies in property details.

- Submit a formal appeal to the County Assessor's Office within the specified timeframe.

- Attend a hearing if necessary, where you can present your case and discuss your concerns with the assessment board.

Appealing a property tax assessment can be a complex process, but it is essential for ensuring fair and accurate taxation.

The Impact of Property Taxes on Homeowners

Property taxes have a significant impact on homeowners in Spartanburg County, SC, influencing their overall cost of living and financial planning. Understanding these impacts can help homeowners make informed decisions about property ownership and tax management.

Financial Planning

Homeowners should consider property taxes as a long-term expense when budgeting for their homes. Factoring in annual tax payments can help prevent financial strain and ensure timely payments.

Property Value Appreciation

As property values appreciate over time, so do property taxes. Homeowners should be aware of this trend and plan accordingly, especially when considering renovations or upgrades that may increase their property's assessed value.

How Property Taxes Fund Public Services

The revenue generated from property taxes in Spartanburg County, SC, is allocated to fund essential public services that benefit the entire community. Understanding how these funds are used can provide insight into the importance of property taxes and their role in maintaining a high quality of life.

Education

A significant portion of property tax revenue is dedicated to funding public schools in Spartanburg County. This includes teacher salaries, school maintenance, and educational programs that support student success.

Infrastructure and Public Safety

Property taxes also fund infrastructure projects such as road maintenance, bridge repairs, and public transportation. Additionally, they support law enforcement and emergency services, ensuring the safety and security of residents.

Future Trends in Property Taxes

The landscape of property taxes in Spartanburg County, SC, is continually evolving, influenced by economic conditions, legislative changes, and demographic shifts. Staying informed about these trends can help property owners anticipate changes and plan accordingly.

Potential Tax Rate Adjustments

As the county's population grows and development increases, there may be pressure to adjust property tax rates to meet rising budget demands. Homeowners should monitor these changes and participate in public discussions to have their voices heard.

Technology and Automation

The use of technology in property tax assessments and administration is becoming more prevalent, offering increased accuracy and efficiency. Embracing these advancements can streamline the tax process and improve transparency for taxpayers.

Kesimpulan

Property taxes in Spartanburg County, SC, play a vital role in funding essential public services and maintaining the community's infrastructure. By understanding how these taxes are assessed, calculated, and applied, homeowners and property investors can better manage their financial obligations and contribute to the county's growth and development.

We encourage you to take action by reviewing your property tax assessment, exploring available exemptions, and staying informed about future trends. Share your thoughts and experiences in the comments below, and don't forget to explore other informative articles on our website.

Remember, staying informed is the key to effective property tax management and ensuring a prosperous future for Spartanburg County's residents.