Comprehensive Guide To Maricopa Tax Assessor Property Search: Your Ultimate Resource

Searching for property records in Maricopa County? The Maricopa Tax Assessor Property Search is your key to accessing comprehensive data on real estate within the region. Whether you're a homeowner, buyer, or investor, understanding how to navigate this system is essential for making informed decisions.

Maricopa County, one of the fastest-growing regions in Arizona, offers an advanced property search system managed by the Maricopa County Assessor's Office. This tool provides vital information such as property ownership, assessed values, and tax details. For anyone involved in real estate transactions, this system is an invaluable resource.

In this article, we will delve deep into the Maricopa Tax Assessor Property Search, exploring its features, benefits, and how it can assist you in managing your property-related needs. Let's dive in!

Read also:How To Use Secure Remote Access To Raspberry Pi

Table of Contents

- Introduction to Maricopa Tax Assessor Property Search

- Benefits of Using Maricopa Tax Assessor Property Search

- How to Use Maricopa Tax Assessor Property Search

- Understanding Property Data in Maricopa County

- Search Options Available in the System

- Accessing Ownership Details

- Understanding Tax Information

- Legal Descriptions and Property Boundaries

- Using Property Search for Market Analysis

- Tips for Efficient Property Searches

- Conclusion

Introduction to Maricopa Tax Assessor Property Search

The Maricopa Tax Assessor Property Search is a digital platform designed to provide transparent and accessible information about properties within Maricopa County. This tool is essential for anyone seeking detailed property records, including homeowners, real estate agents, and investors. By leveraging this system, users can gain insights into property assessments, tax liabilities, and ownership details.

Maricopa County's property search system is powered by cutting-edge technology, ensuring accuracy and efficiency. It allows users to search for properties using various parameters such as address, parcel number, or owner name. The system also provides access to historical data, enabling users to track changes in property values and tax assessments over time.

Benefits of Using Maricopa Tax Assessor Property Search

Convenience and Accessibility

One of the primary advantages of the Maricopa Tax Assessor Property Search is its convenience. Users can access property records anytime, anywhere, as long as they have an internet connection. This eliminates the need for in-person visits to government offices, saving time and effort.

Comprehensive Data

The system offers a wealth of information, including property descriptions, assessed values, and tax history. This comprehensive data empowers users to make well-informed decisions regarding property purchases, sales, or investments.

Transparency and Accountability

By providing transparent access to property records, the Maricopa Tax Assessor Property Search promotes accountability and fairness in the real estate market. Users can verify property details and tax assessments, ensuring accuracy and preventing discrepancies.

How to Use Maricopa Tax Assessor Property Search

Step-by-Step Guide

Using the Maricopa Tax Assessor Property Search is straightforward. Follow these steps to access property records:

Read also:Patriot Ledger Newspaper Quincy Massachusetts A Comprehensive Guide To The Renowned Publication

- Visit the official Maricopa County Assessor's website.

- Navigate to the property search section.

- Select your preferred search method (address, parcel number, owner name).

- Enter the required details and submit your query.

- Review the results and access the desired property information.

Search Parameters

The system supports multiple search parameters, allowing users to refine their queries based on specific criteria. Whether you're searching by address, parcel number, or owner name, the platform ensures accurate and relevant results.

Understanding Property Data in Maricopa County

Property data in Maricopa County encompasses a wide range of information, including physical characteristics, ownership details, and tax assessments. Understanding these elements is crucial for anyone involved in real estate transactions.

Key Data Points

- Property Address: The physical location of the property.

- Parcel Number: A unique identifier assigned to each property.

- Owner Information: Details about the current property owner.

- Assessed Value: The official valuation of the property for tax purposes.

Search Options Available in the System

Address Search

Searching by address is one of the most common methods used in the Maricopa Tax Assessor Property Search. Simply enter the street address, city, and zip code to retrieve property details.

Parcel Number Search

For more precise results, users can search using the parcel number. This method is particularly useful for properties with similar addresses or names.

Accessing Ownership Details

Ownership details are a critical component of property records. The Maricopa Tax Assessor Property Search provides comprehensive information about the current and previous owners of a property.

Why Ownership Details Matter

Knowing the ownership history of a property is essential for various reasons, including:

- Verifying legal ownership before purchasing.

- Identifying potential liens or encumbrances.

- Understanding the property's market history.

Understanding Tax Information

Tax information is a key feature of the Maricopa Tax Assessor Property Search. Users can access detailed records of property taxes, including assessed values, exemptions, and payment history.

Factors Affecting Property Taxes

- Property Size and Location

- Market Conditions

- Local Government Policies

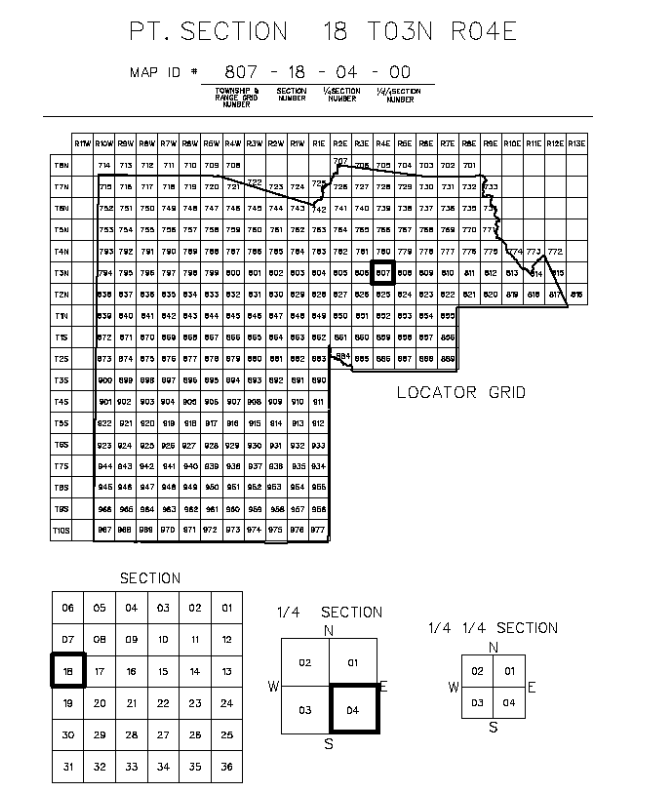

Legal Descriptions and Property Boundaries

Legal descriptions and property boundaries are essential for understanding the extent of a property's ownership. The Maricopa Tax Assessor Property Search provides detailed maps and descriptions to help users visualize property boundaries.

Importance of Accurate Legal Descriptions

Accurate legal descriptions prevent disputes and ensure clear ownership boundaries. They are particularly important during property transactions or legal proceedings.

Using Property Search for Market Analysis

The Maricopa Tax Assessor Property Search is a valuable tool for market analysis. By accessing historical data and comparing property values, users can gain insights into market trends and investment opportunities.

Key Metrics for Market Analysis

- Average Property Values

- Tax Assessment Trends

- Ownership Turnover Rates

Tips for Efficient Property Searches

To maximize the benefits of the Maricopa Tax Assessor Property Search, consider the following tips:

- Start with specific search parameters for better results.

- Verify data from multiple sources for accuracy.

- Use historical data to identify long-term trends.

Conclusion

The Maricopa Tax Assessor Property Search is an indispensable tool for anyone involved in real estate within Maricopa County. By providing transparent and comprehensive property data, it empowers users to make informed decisions. Whether you're a homeowner, buyer, or investor, this system offers the information you need to navigate the real estate market successfully.

We encourage you to explore the Maricopa Tax Assessor Property Search and take advantage of its features. Share your thoughts and experiences in the comments below, and don't forget to explore other articles on our website for more insights into real estate and property management.

For further reading, consider reviewing the official Maricopa County Assessor's website for additional resources and updates.